The #1 Independent Insurance Agency in Orlando, FL

Safeguard your assets and protect your future with our comprehensive insurance coverage. We’ll assess your risks, tailor coverage to your needs, and connect you with top-rated carriers for added security and peace of mind. Schedule a consultation today to discuss your needs.

"Bellken Insurance Group was a great help in making sure that we had all of the necessary Homeowner Association insurance coverages in place. We appreciate their professionalism and would highly recommend them."

-

Diane S. Secretary-Treasurer LHVCA, Inc.

About Us

Top-Rated Insurance Agency in Orlando, Florida

Our agency has developed the necessary relationships with our numerous "A" rated carriers that allow Bellken Insurance Group to provide the most competitive quotes for clients. The professional and tenured partnerships with our carriers allow us the flexibility to address your interests and possible exposures accurately. As a client or prospect, you will deal exclusively with your own Bellken Insurance Group licensed agent every step of the way, thus allowing us to serve your needs effectively.

From beginning to end, the professional team at

Bellken Insurance Group goes all out to make obtaining the right coverage easy to understand. Getting the right policy to cover your risk while still getting maximum value is one of the many benefits of working with Orlando's top-rated insurance agency.

MEET THE BELlKEN EXECUTIVE TEAM

Bellken Insurance Advisors

Manage Your Business Risk

Commercial Insurance Solutions to Protect Your Business

Florida Workers Compensation Insurance

Workers Compensation Insurance is a type of insurance that employers purchase to cover the expenses they incur when an employee gets injured on the job.

Florida General Liability Insurance

Liability insurance is a type of coverage that protects your business and its assets from lawsuits, paying damages to the plaintiff in the event of a claim.

Florida Business and Commercial Property Insurance

Business and commercial property insurance is a type of insurance that covers the business for losses due to fire, theft, vandalism, etc.

Florida Business Owner's Policy (BOP)

A Business Owner's Policy (BOP) is a type of business insurance that covers a broad range of exposures for the owner and their employees.

We provide Commercial Insurance For A Wide Array of Businesses

Industries Served

Committed to providing our insureds with superb coverage through the careful and diligent underwriting of their individual risks.

Manage Your Personal Risk

Individual Insurance Solutions to Protect Your Self & Family

Florida Home Insurance

Home insurance is a type of insurance that protects the home, its occupants, and any other structures on the property from financial loss.

Florida Auto Insurance

Liability insurance is a type of coverage that protects your business and its assets from lawsuits, paying damages to the plaintiff in the event of a claim.

Florida Personal Umbrella Insurance

Umbrella insurance is an insurance policy that provides coverage for losses in excess of the underlying liability limits of the primary insurance.

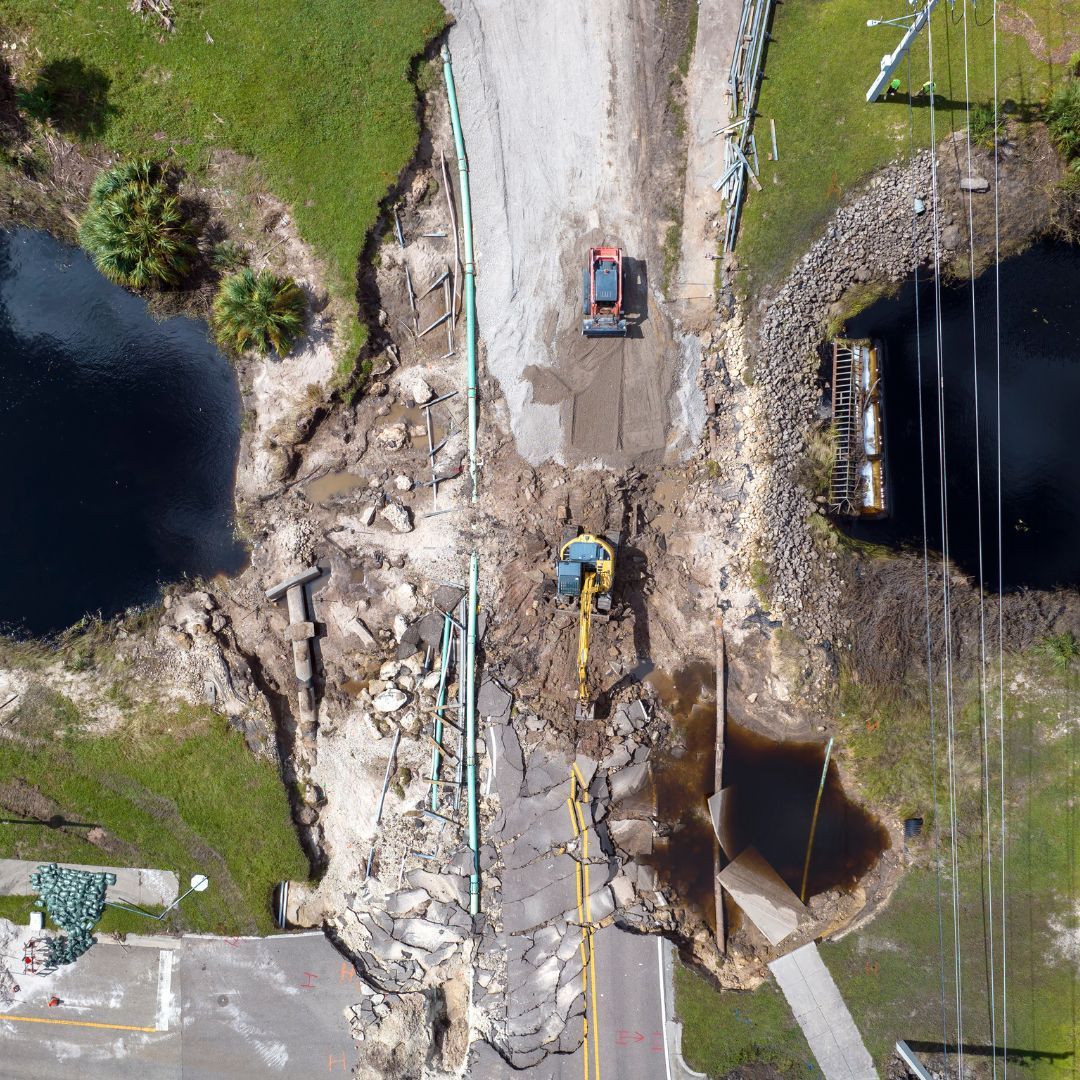

Florida Flood Insurance

Flood insurance is a type of property insurance that covers damage to property caused by flooding.

Why Choose Bellken Insurance Group

Bellken Insurance Group believes that insurance should be more than just a transaction. We strive to build lasting client relationships, providing personalized solutions and exceptional service. Discover the difference of partnering with a trusted insurance agency in Orlando.

- Competitive Quotes: Get personalized and affordable insurance quotes from our extensive network of top-rated carriers.

- Long-Term Partnerships with Insurance Carriers: Access our broad network of 'A' rated carriers for the best coverage and service.

- Work Exclusively With an Agent: Receive dedicated attention and expert guidance from a licensed agent every step of the way.

- Proactive Risk Assessment: Identify potential risks and provide proactive solutions to minimize exposure.

- Responsive Customer Service:

Receive prompt reverts to inquiries. We ensure you get the information you need when you need it.

Testimonials

Our Service Process

Ensure a stress-free insurance experience with our streamlined approach.

Step 1: Consultation

The consultation process involves assessing your insurance needs and providing you with options from multiple companies. Our agents will then guide you in selecting the best coverage and assist with paperwork and claims.

Step 2: Assessment

Our team of experts will assess your current coverage and recommend any adjustments or additional coverage you may need.

Step 3: Comparison

We'll compare quotes from multiple insurance providers to find the best coverage options for your needs and budget.

Step 4: Tailor Coverage

Based on our assessment and comparison, we'll tailor a coverage plan specifically for you. You'll be assigned a dedicated agent who will serve as your single point of contact for all your insurance needs, including policy changes, claims, and questions.

Step 5: Ongoing Review

We'll regularly review your policies to ensure that your coverage remains up-to-date and continues to meet your changing needs.

Our BLOG